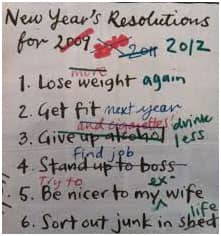

The start of the new calendar year always spurs a flurry of New Year Resolutions related to well intentioned lifestyle changes; but sadly, it is the rare exception when these resolutions are actually kept. As an insurance broker, however, the one I encourage all my clients to keep is to review their life insurance coverage. These policies can have profound impact on all members of your family; so it is a resolution that is definitely worth keeping.

If you have a family with children, or a non-working spouse, that relies on you for income; you really should have a life insurance policy in place. I usually recommend getting started with a Term Insurance policy. Term policies are quite affordable. These type of policies have no cash value, run for a set period of years usually 10,15,20, 30 years, and pay if the insured were to die during that term.

To assess the amount and term of coverage you need, I would start by answering the following questions:

* How many years until your children will be living independently and fully self sufficient? Don’t underestimate here; the transition for fully dependant to independent is often a gradual process.

* If you were to die, would your spouse be able to return to work? If not, how much money would you need to replace your income and for how long?

* What additional costs might there be in order to care for your children?

* What are your mortgage and future education costs?

By answering these simple questions, you can easily arrive at a suitable term and amount of coverage that should be carried by the primary income earner of the family.

One area that clients often overlook is life insurance coverage on the non-earning spouse. Running a family household and raising kids is usually a team effort, so it is important to examine how the potential loss of a non-earner may impact the primary breadwinner.

* If your spouse were to die; would you be able to continue working in your current job? Would your family obligations require you to change your work routine?

* If you would be able to continue in your current job, how will you cover the additional household responsibilities and child care? And what will be the costs associated with that?

None of us like to think of our own mortality, but taking a little time to review life insurance coverage now will give everyone piece of mind and ensure your loved ones are always taken care of. If you would like to discuss your current policy or establish one, please give us a call at Kaplan Insurance.